Let’s talk about money.

In our previous article, we mentioned that finances are one of the biggest stressors around the holiday season. You’ve got gift-giving, holiday decorations, food and drinks, parties and gatherings, travel expenses; extra costs that are not typical during the rest of the year.

I have some personal experience with poor financial management that was often exacerbated by the holiday season in the past. But in the last few years, taking care of my financial health and getting my affairs in order has been a priority. So I’m here to tell you, it doesn’t have to be like this.

The first step is understanding what this looks like. In this article, we’ll explore the ins and outs of managing finances during the holidays. We’ll also navigate the pressures of gift-giving and offer creative solutions to celebrate without breaking the bank.

Understanding Financial Health During the Holidays

So, what does financial health even mean?

I’m not talking about just numbers on your bank statement or your budget for the month. It’s the idea and practice of making informed, financial decisions that contribute to your overall health and well-being. This is not just about spending money but understanding your psychology, behavior, and relationship with money.

When I don’t have money, I’m stressed. When I’m in debt, I’m stressed. When my bank account is looking low, you guessed it, I GET STRESSED!

Then enter the holiday season.

In general, understanding and managing your financial health in your daily life is an extremely important practice. But during the holidays, it’s even more crucial. This involves assessing your spending habits (perhaps even before the holidays), setting realistic budgets, and avoiding the pitfalls of unnecessary debt.

Here are some questions to reflect on as you start to think about your financial health:

- What are the triggers that make me want to spend?

- What is my spending habit like?

- What do I usually spend on?

- How do I feel after I spend?

Learn more about how to overcome emotional spending.

Statistics on Holiday Spending

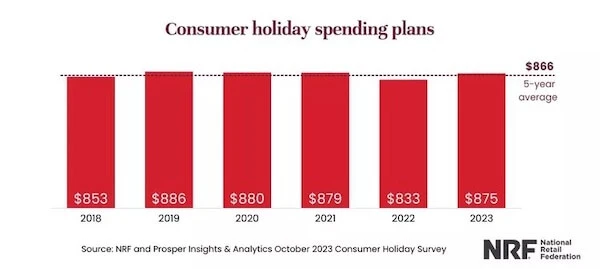

It goes without saying that there is a significant surge in spending during the holiday season. It’s a jackpot for retailers and corporations. With consumers (like us) pouring billions into the economy, this could mean a rabbit hole of accumulating debt that extends well into the new year… and beyond.

To understand the magnitude of holiday spending, let’s take a look at some data.

According to Investopedia, “Holiday retail sales in November and December 2023 are expected to grow 3% to 4% to a new record of between $957.3 billion and $966.6 billion. That’s a jump from the $929.5 billion record set in 2022. Prior to this, sales averaged an increase of 3.6% from 2010 to 2019.”

Yes, this is happening despite crazy inflation, higher gas prices, stringent credit card conditions, and insanely elevated interest rates!

The pressure and personal urge to spend during this time of the year can lead people to overspend beyond their means, resulting in an accumulation of credit card debt. This is an extremely dangerous and concerning threat to the financial well-being of many households. This can lead to credit card delinquencies and become a never-ending cycle, making you feel like you’re never going to be able to pay off your debts.

In fact, the delinquency rate for credit cards that were at least 90 days past due was 5.32% and rising, with young Americans (ages 18-29) suffering the highest delinquency rates of 9.36%. That’s 76% higher than the total average credit card delinquency rate!

According to the New York Federal Reserve, “Americans’ total credit card balance is $1.079 trillion in the third quarter of 2023… That’s up from a record $1.031 trillion in the second quarter of 2023, leaving the balance the highest since the New York Fed began tracking in 1999. This marks the second consecutive quarter in which Americans’ credit card balances topped $1 trillion, which had never happened prior to the second quarter of 2023.”

I’m sure this is no surprise to any of you, of course, people spend the most during the holiday season! But have you ever stopped to wonder why so many of us are willing to go into more debt over the holidays? And how many people don’t recover?

The Pressure of Holiday Gift-Giving

Gift-giving has always been a fun and meaningful tradition during the holidays, but it has gotten way out of control! Yes, it’s nice to give gifts and even nicer to receive. But just as important in considering the kinds of gifts we want to give and receive.

Societal expectations, personal desires to make loved ones happy, and the barrage of Black Friday and Cyber Monday deals can create a perfect storm of financial stress. I know the discounts are extremely alluring, but let’s explore ways to navigate this pressure gift-giving and find alternatives.

Solutions

Setting and Sticking to a Budget

I cannot stress this enough – set a realistic budget and stick to it.

I’ve had personal struggles with this one where I either set a lackluster budget that I barely followed or avoided it altogether because it was too daunting to look at the numbers. I’ll be honest, finances stresses me out, and this avoidance led me down a dark path of debt that I’m just emerging from now.

So don’t make the mistakes that I’ve made for many years and create your budget. Remember, a well-planned budget is your shield against unnecessary debt.

Communicating Financial Boundaries

Open communication with friends and family about financial boundaries is crucial during the holidays. Share your budgeting goals, explore cost-sharing options, and foster a supportive environment that values thoughtful gestures over extravagant gifts. Clear communication ensures everyone is on the same page, reducing the pressure to overspend.

Alternatives to Traditional Gift-Giving

I want to encourage everyone to consider shifting away from the conventional gift-giving mindset and traditions this holiday season. Instead, let’s explore ways we can still give a meaningful gift and create memories without breaking the bank. There are so many ways to show people that we love and care for them!

Here are some creative alternatives to celebrate the holidays with meaning (some are more common than others):

- Potluck Parties

- Food and Baked Goods

- Swap Cocktails

- DIY Delights (hand-made jewelry, scrapbooking, writing a letter, etc.)

- Secret Santa

- White Elephant

- Gift Experiences (spa day, paint night, concert tickets, travel together, etc.)

- Gift an Investment (transfer stock)

- Virtual or Digital Gifts (online courses, audiobook, meal subscriptions, etc.)

- Charitable Contributions

- Donate to a charity on someone’s behalf

- Sponsor a family in need

Remember, you don’t have to go at gift-giving alone. Pitch in as a group to get someone a gift. And for gifting experiences, especially travel experiences, everyone can contribute to make a memorable trip happen rather than buying material things.

However you decide to go about it, keep in mind that the most important thing is that you are spending quality time and making meaningful memories with those you love and care about; it’s not about the money or the gift.

Final Thoughts

Amid the hustle and bustle of the season, take a moment to reflect on the true meaning of the holidays. Cultivate gratitude for the people in your life and the experiences you share. Shifting the focus from material possessions to the richness of relationships adds depth and joy to your celebrations.