Are you constantly spending money on things you don’t need? Do you find yourself buying things to make yourself feel better or to relieve stress? If so, you’re not alone.

Emotional spending is a common toxic habit that many people struggle with, and it can have serious consequences on your finances and mental health.

Trust me, I’ve also been guilty of this.

In fact, a recent study found that 39% of Americans identify as emotional spenders. More than half of the respondents (54%) said they would rather spend money on retail therapy than actual therapy to cope with their emotions.

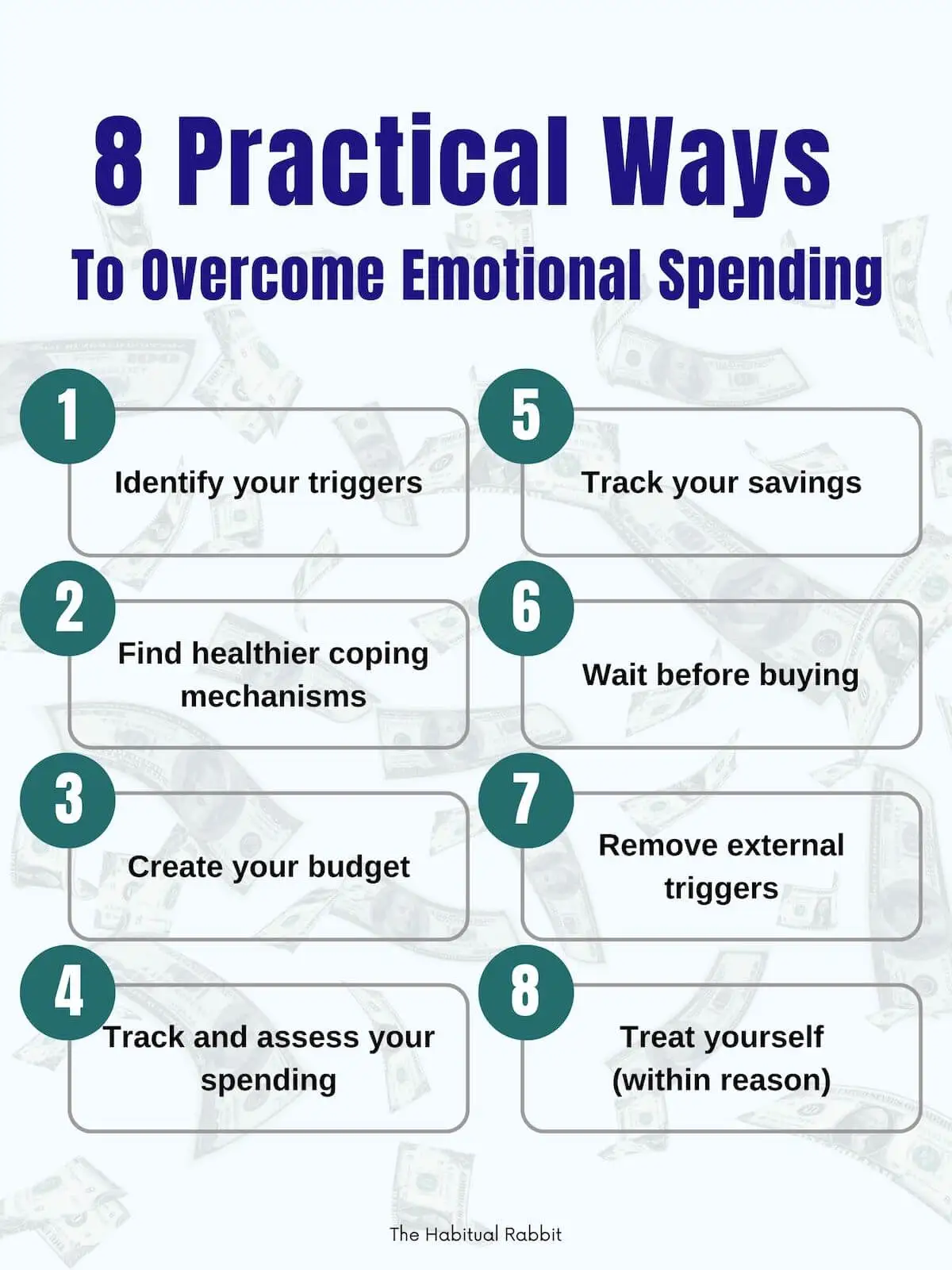

The good news is that by understanding the root causes of emotional spending and implementing the right strategies, you can overcome this habit and take control of your spending.

In this guide, we’ll explore the reasons why we spend emotionally, how to recognize and break the cycle, and practical tips for building healthy spending habits. Whether you’re dealing with stress, anxiety, or simply trying to fill a void, these tips will help you manage your money better and build a brighter financial future.

Understanding Emotional Spending

Emotional spending is a behavior that involves making purchases as a way to cope with negative emotions. When we feel overwhelmed by our emotions, we may turn to shopping as a way to distract ourselves or find temporary relief. However, emotional spending can quickly become a problematic habit, leading to financial instability and emotional distress.

One reason why emotional spending can be so difficult to overcome is that it often feels good at the moment. The act of buying something new can release dopamine in the brain, which is associated with pleasure and reward. This can create a cycle of emotional spending, where we continue to seek out that temporary high, even if it means putting ourselves in a worse financial situation. Sound familiar?

Most of us have been guilty of this at one point or another, and that’s okay. The most important thing is being aware of this and acknowledging that this is a problem that you want to address. That’s why we’ve put together this well thought out list of tips and tricks to help you identify the issue and overcome your emotional spending habits.

1. Identify your triggers

To overcome emotional spending, it’s important to identify our triggers and thought patterns. This can help us understand why we engage in this behavior and develop healthier coping mechanisms. Some common triggers for emotional spending may include:

- Stress

- Jealousy

- Anxiety

- Loneliness

- Boredom

- Depression

- Low self-esteem

- Guilt

- Fear

- Achievement

What triggers prompt you to engage in emotional spending? What do you tend to buy when you’re feeling depressed, bored, or stressed? How much money do you typically spend?

Only by becoming aware of our triggers can we begin to develop strategies for managing them in a healthier way.

2. Find healthier coping mechanisms

To overcome emotional spending, it’s important to develop healthy coping mechanisms so we can tackle the core of the issue and effectively manage our emotions.

In her book, Your Money or Your Life, Vicki Robin states that “we have learned to seek external solutions to signals from the mind, heart or soul that something is out of balance”. What this means is that we try to fulfill our psychological and spiritual needs through physical consumption.

By understanding the underlying reasons behind our emotional spending, we can directly address the emotions driving these actions. For instance, if stress leads you to buy new clothes, focus on finding healthier ways to alleviate that stress. Consider going for a walk in nature or engaging in a quick workout.

3. Create your budget

If you have a tendency to engage in emotional spending, it’s common to end up spending more than you earn on a regular basis. Therefore, to overcome emotional spending, it’s important to create a budget and financial plan that aligns with your goals and values. Being financially accountable means knowing exactly how much money is flowing into and out of your life.

Start by setting a budget that ensures you spend less than what you earn monthly. Identify the financial objectives you want to achieve, such as paying off debts, saving for retirement, or establishing an emergency fund. Take into account upcoming expenses like rent, bills, taxes, and loan payments.

When it comes to credit cards, aim to pay off the full bill every billing cycle. Consider setting up autopay to avoid forgetting payments. Remember that only making minimum payments will increase your debt and tempt you to spend more.

4. Track and assess your spending

Keeping a close watch on your spending habits allows you to grasp the financial impact of emotional spending.

When tracking your expenses, it’s important not to take shortcuts. Account for every single cent that you spend. Categorize your expenses into different categories such as food, clothing, entertainment, and beauty. This will provide a clearer picture of where your money is going.

At the end of each week or month, take time to reflect on your purchases. How much did you spend on entertainment, for example? Ask yourself why you spent that amount and whether you received long-term value from that expenditure. Evaluate whether the amount you spent aligns with the fulfillment you derived from it.

In addition to asking these tough yet necessary questions, create a chart that displays your monthly spending. This visual representation will assist you in determining whether you have been spending excessively. You will also gain a better understanding of your financial situation and make adjustments as needed.

5. Track your savings

Finding joy in saving money rather than spending is another powerful strategy for overcoming emotional spending.

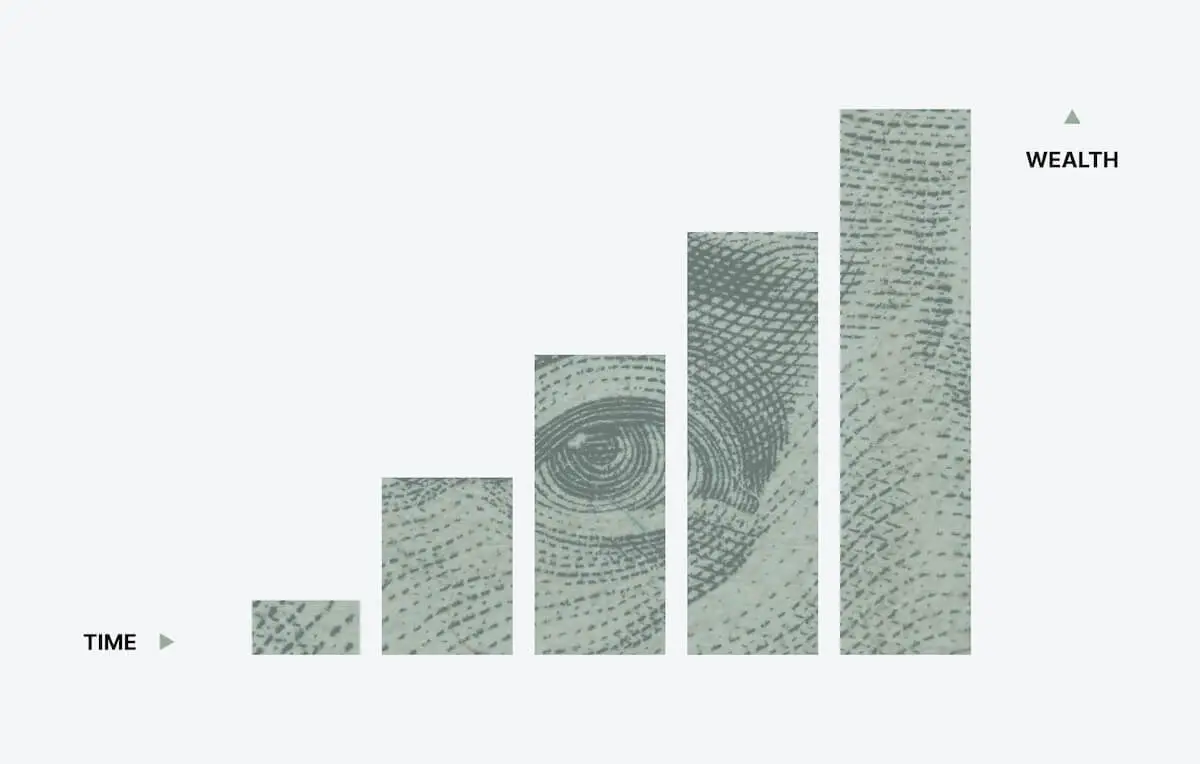

If self-control is a challenge for you, establish an automatic transfer of a set amount to your savings account each month. This proactive step reduces the temptation to spend impulsively. Similarly to tracking your spending, create a chart to visualize the growth of your savings on a monthly basis.

By allocating funds for savings and witnessing your savings accumulate over time, you can experience feelings of joy, self-confidence, and control. These are the same emotions you sought to achieve through emotional spending. The key difference is that saving money benefits your financial health and future.

In addition to regular savings, consider setting aside money for investments. For instance, if you tend to spend excessively on Apple products, why not invest in Apple stock instead? Successful investments can increase your net worth and generate additional income.

6. Wait before buying

When facing the challenge of emotional spending, it’s important to stop and give yourself time before making a purchase. This practice helps eliminate impulsive buying and prevents you from experiencing buyer’s remorse later on.

Take a waiting period of 24 or 48 hours, or however long you need to allow your emotions to settle. The larger the purchase, the more time you may require to think rationally about whether you truly want or need the item.

During this waiting period, ask yourself essential questions. Consider when and how often you would use the item. Reflect on the lasting value it would provide. Evaluate whether purchasing it serves a purpose moving forward. Explore if there are more cost-effective or creative alternatives to achieve the same outcome.

By taking this time for reflection, you regain control over your spending and make more informed decisions, ensuring they align with your genuine needs and goals.

7. Remove external triggers

Minimizing external triggers and creating a more intentional environment will help support your efforts to control emotional spending and make mindful financial choices. Consider implementing the following steps:

- Remove spending apps from your smartphone

- Unsubscribe from promotional emails and newsletters

- Disable one-click shopping and delete your payment information on online shopping platforms

- Avoid using “buy now, pay later” services

- Leave your credit card at home when it is unnecessary

Studies show that 24% of Gen Z and 21% of millennials engage in emotional spending while in bed, with an additional 18% of Gen Z and 13% of millennials doing so while scrolling through social media. Therefore, reducing your time on social media, particularly before bed, can also help curb impulsive spending.

8. Treat yourself (within reason)

Occasional emotional spending is perfectly acceptable so long as you’re staying on track with your financial goals. Treating yourself is a form of self-care that can bring joy and fulfillment!

To ensure that your emotional spending remains in check, establish a dedicated budget for such expenses. Set a weekly or monthly limit and stick to it. You can even designate a specific day of the week when you can make these indulgent purchases, whether it’s enjoying a nice meal or treating yourself to a relaxing massage.

By adopting mindful spending habits, you become more intentional in your purchasing decisions and make choices that provide the greatest value for you. You will also create your own internal yardstick for fulfillment and know what is “enough” for you.

Final Thoughts

Emotional spending can be a difficult habit to break, but with the right strategies, you can reclaim control over your spending and improve your emotional well-being. By identifying your triggers, cultivating healthy coping mechanisms, and maintaining discipline with your financial goals, you can break free from emotional spending for good!